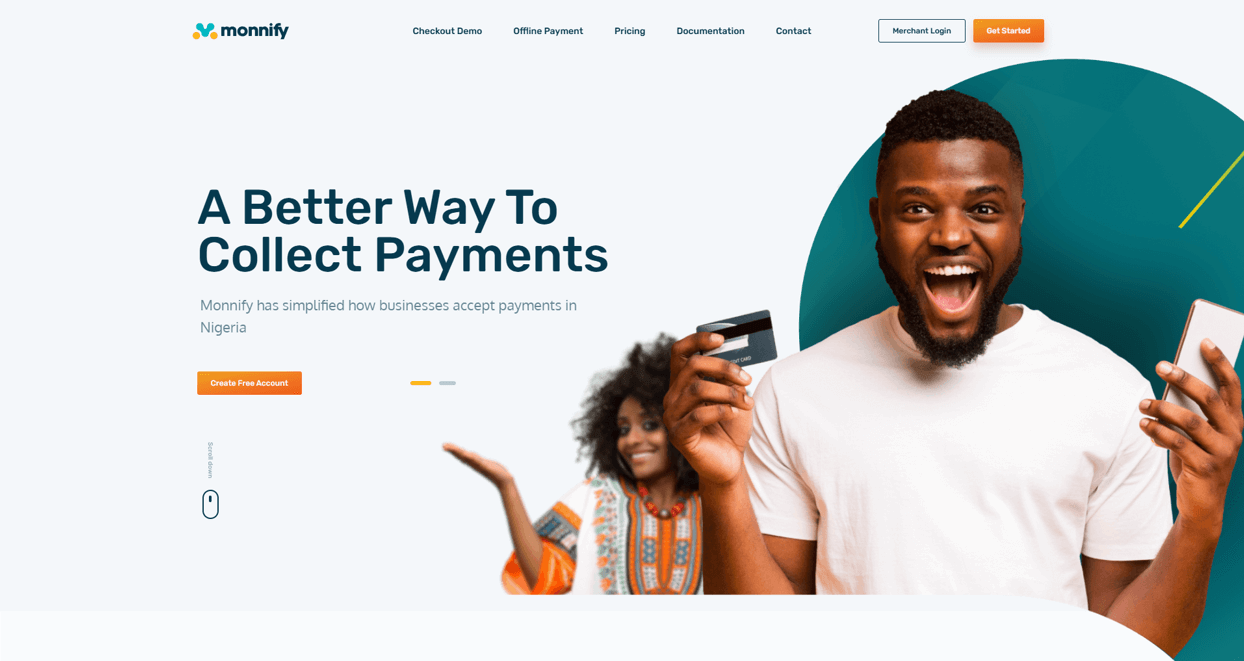

Monnify is a Nigerian payment gateway that enables businesses to accept one‑time and recurring payments. It offers a faster, cheaper way for companies to receive payments via web and mobile applications using various methods, and boasts industry‑leading success rates

Visual showcase of the project’s key features and interfaces

Payment success rates exceeding 99%, widespread adoption by merchants.

Explore other projects in our portfolio